In investing, it’s just as important to know what to buy as what to avoid.

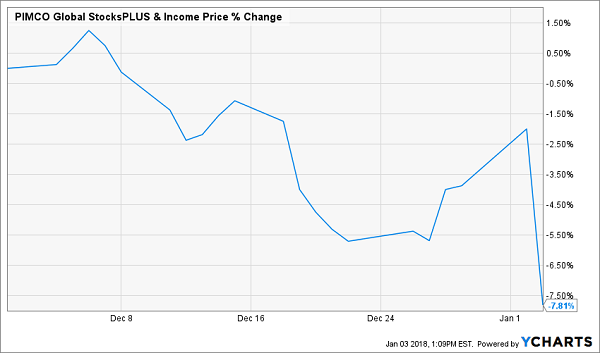

And if there’s one thing you need to keep away from at all costs, it’s a dividend cut like the huge 50.6% slash the PIMCO Global StocksPLUS & Income Fund (PGP) announced on January 2.

It caught first-level investors completely off guard (though it shouldn’t have, as I’ll explain in a moment).

Here’s how they responded:

And Down She Goes

If you’re a regular reader of my articles on ContrarianOutlook.com, you’ll recognize PGP, a PIMCO fund that mixes stocks and bonds to give investors the biggest dividend possible.…

Read more

Recent Comments