It’s Tax Day—the perfect time to talk about one of our favorite income plays: municipal bonds.

Don’t listen to anyone who tells you “munis” are boring. They’re anything but: It’s easy to grab 5%+ yields from them. And because munis’ income is tax-free for most Americans, that 5% is worth more—in some cases a lot more—to us.

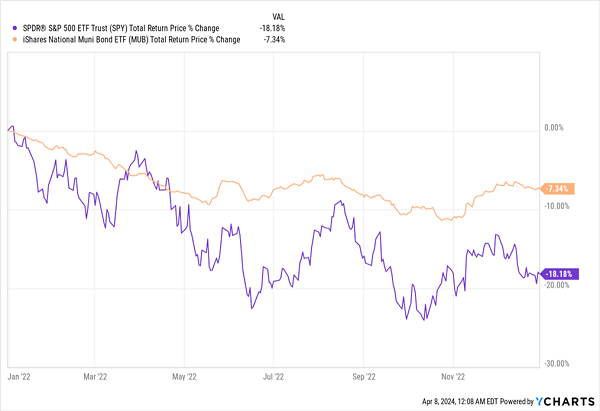

They’re stable, too. Consider how much better you’d have slept at night if you held munis during the 2022 nightmare, when they held up much better than stocks:

2022 Put Muni Bonds’ “Crash Resistance” on Display

Truth is, yearly declines of any sort are unusual for munis, which tend to deliver 5% to 6% annual total returns in the long run—and that’s before their tax benefits, which are, quite frankly, game-changing.… Read more

Recent Comments