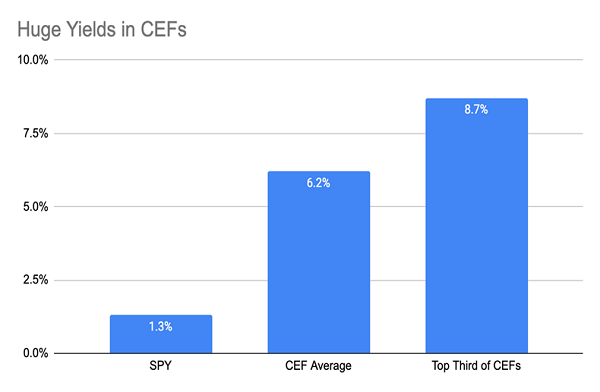

At my CEF Insider service, we’ve been bullish on corporate bonds (especially corporate bond–focused closed-end funds yielding 8%+) for a long time now.

We remain so, because we’ve got a nice “goldilocks” setup for these funds right now:

- The US economy, while not booming at a rate that makes everyone happy, has steadily improved since the pandemic, prompting inflation to slow but remain elevated.

- The Federal Reserve, seeing this, is getting set to lower interest rates in late 2024, or possibly at some point next year.

These are both bullish signs for corporate bonds—and the closed-end funds that hold them. I’m sure I don’t have to tell you they were hit hard in 2022, resulting in an array of bargains.… Read more

Recent Comments