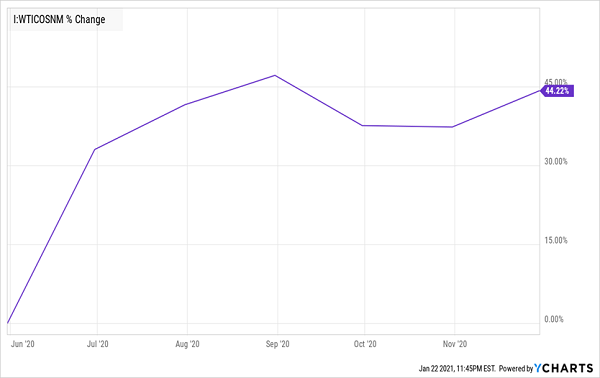

If you made money investing in oil this year, congratulations! But I have a warning: now is the time to take profits—especially if you hold the two oil funds we’ll discuss below.

Before we get to those, let’s talk a little more about oil’s big year. If you bought earlier in 2022, you managed to pick up on the only sector in the green this year—and well into the green, too: the Energy Select Sector SPDR ETF (XLE), a good benchmark for oil stocks, has climbed 55% so far in 2022, while the S&P 500 has headed the other way, dropping some 20%.… Read more

Recent Comments