When it comes to closed-end funds (or any investment, for that matter), it pays to look for things most people misunderstand. Because these (seemingly) tiny investor oversights and errors can give us keen-eyed contrarians our best buying opportunities.

And when it comes to CEFs, there’s one all-too-common mistake I see folks make time and time again, particularly those who are new to these high-yielding funds. To see what I’m getting at, let’s zero in on a CEF called the Columbia Seligman Premium Technology Growth Fund (STK).

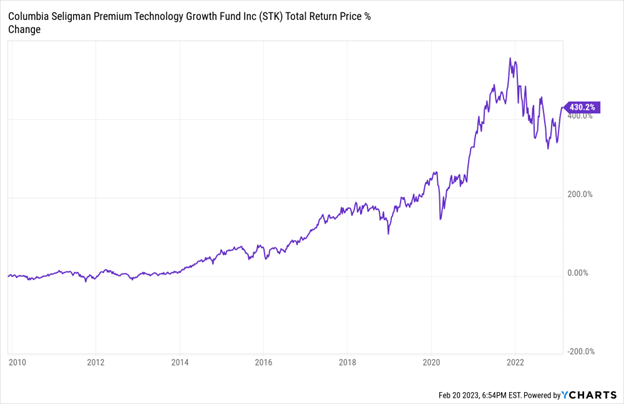

STK Romps to a Triple-Digit Return

STK’s portfolio mainly consists of large-cap tech stocks: Apple (AAPL), chipmaker Broadcom (AVGO) and Microsoft (MSFT) are among its top holdings.… Read more

Recent Comments