Is it possible to double your money – quickly – buying safe dividend stocks? You bet. Let me explain how…

“Basic” income investors are enamored with higher current yields. These are OK for payouts today, but they’re not going to get us 100%+ gains.

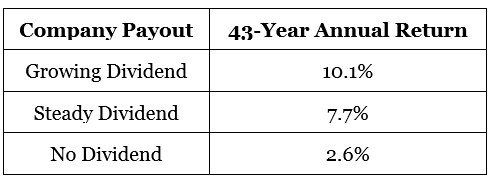

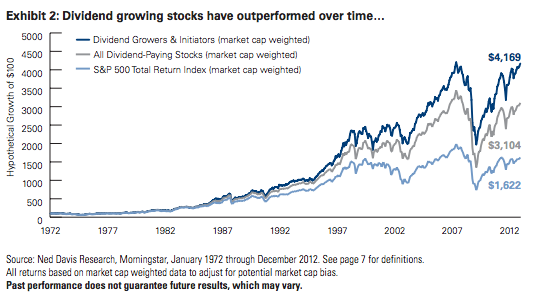

For triple-digit profits we must pay attention to the underrated dividend hike. These raises not only increase the yield on your initial investment, but they trigger stock price increases, too.

For example, if a stock pays a 3% current yield and then hikes its payout by 10%, it’s unlikely that its stock price will stagnate for long.…

Read more

Recent Comments