The One Big Beautiful Bill Act (BBB) is now law—and there’s one contrarian move we can make now to profit from it.

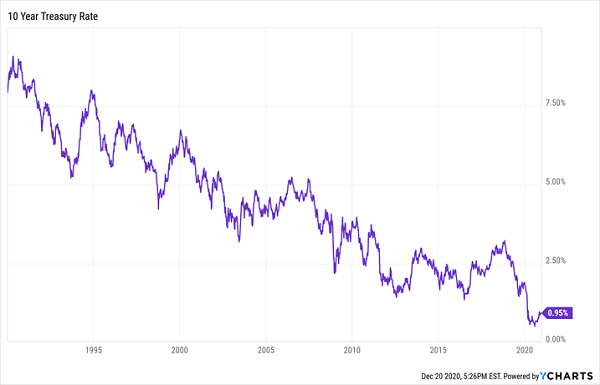

I’m not talking about shorting 10-year Treasuries (though that might work, given the inflationary policies “baked in” here!).

Instead we’re going long—on American oil and gas. But we’re not looking at producers. We’re going with pipeline operators like Kinder Morgan (KMI), a holding in our Hidden Yields dividend-growth service, to ride the $3 trillion in stimulus the BBB is about to set loose.

Why? Two reasons:

- Strong dividends: KMI pays a 4.2% dividend that grows every year, and …

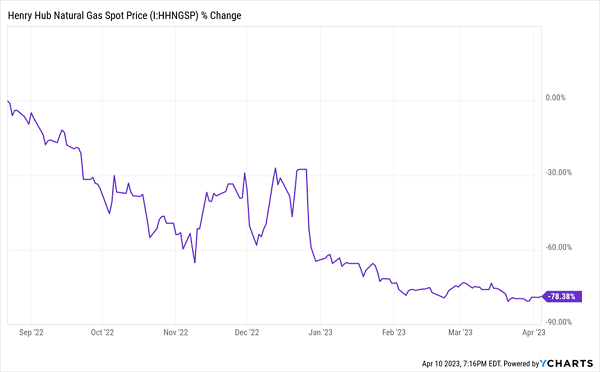

- We get a hedge on oil and gas prices: Most of KMI’s contracts are either “take-or-pay,” under which users are on the hook for the full fee no matter how much product they pump, or “fee-based,” with rates that are fixed no matter what oil and gas prices do.

Recent Comments