What if I told you I’ve found a way to get $1,000 in dividends every single month—and you only need to invest $146,364 to get it?

There’s more, too, because this $1,000 monthly income stream comes from:

- Regular stocks: What I’m about to show you is based on stocks you likely hold now. I’m talking blue chips like NVIDIA (NVDA), Microsoft (MSFT) and Walmart (WMT). The key is to buy these stocks through a special vehicle called …

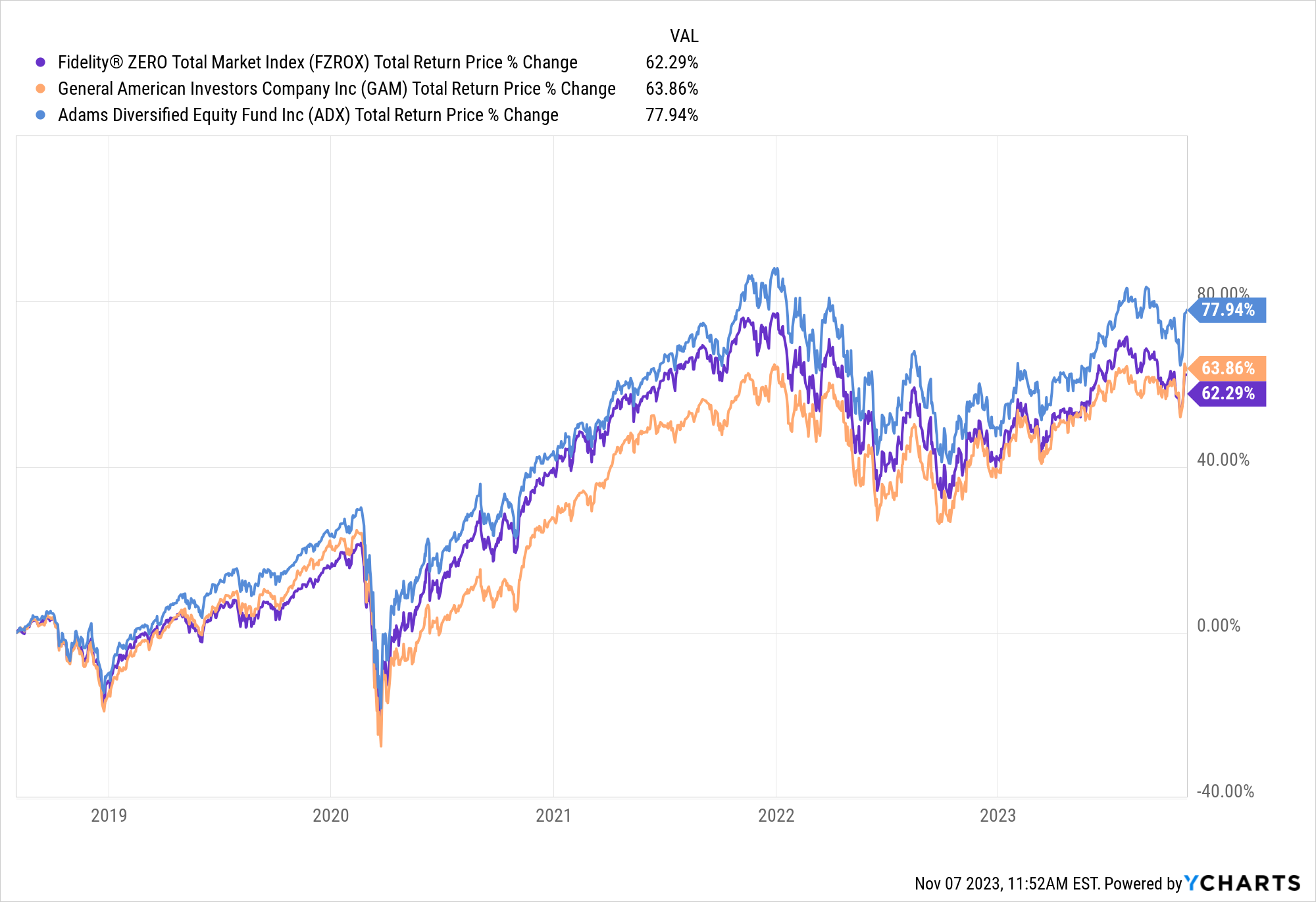

- A closed-end fund (CEF). These ridiculously overlooked funds hold the same assets as ultra-popular ETFs but yield a lot more—8.2% on average.

Recent Comments