The retirement-income battle never ends! Last summer, we watched cautiously for the next dividend cut. This summer, we’re tracking inflation.

No matter the worry, we can apply my “2-step retirement income plan.” It’s designed to keep inflation, another virus wave or pretty well any other calamity from impacting our dividend streams.

Inflation Sideswipes Retirees

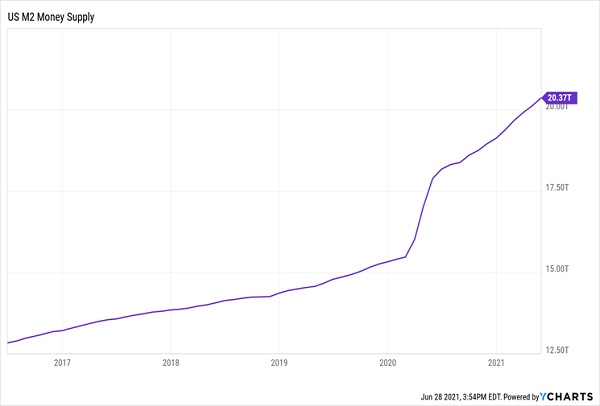

First, though, we can “thank” Jay Powell and his runaway money printer for our sleepless nights. You can’t tell me that goosing the money supply by 30% in a little more than a year doesn’t have something to do with rising prices:

Powell Drains Retirees’ Buying Power

And retirees—the folks with the least amount of wiggle room in their monthly income—are taking the brunt.… Read more

Recent Comments