Ignore the pundits’ petrified bleating over rising interest rates. Sure, the yield on the 10-Year Treasury has spiked to 2.9%, but you’re still not retiring on it!

Look at it this way: if you dropped, say, $500,000 into Treasuries tomorrow, you’d still only get $14,500 in income. That’s just a hair over the poverty line of $14,342 for two people aged 65+ living under one roof.

That’s an insult after a lifetime of hard work!

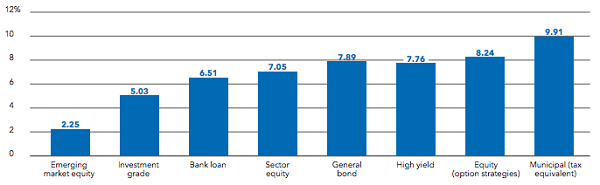

And it’s exactly why I’m going to show you 3 simple steps you can take to rack up safe dividends that average 6.6% now (and some go well beyond 9.4%).…

Read more

…

…

Recent Comments