Select real estate may be the income investing play for 2024. As I write, seven real estate investment trusts (REITs) are dishing dividends from 8.7% all the way up to 15.4%.

These REITs—and their ilk—are literally designed to deliver dividends. That’s how Congress wrote the rules when they legislated these real estate investments into existence back in 1960.

REITs avoid taxes at the corporate level. But in exchange, they need to pony up at least 90% of their taxable income and redistribute it to investors as dividends.

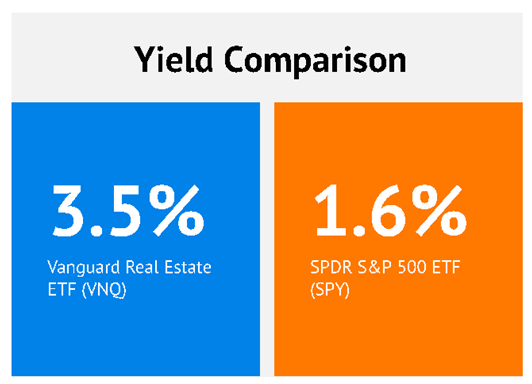

As a result, our average REIT yields somewhere around 2x to 3x the market.… Read more

Recent Comments