Look, we’ve all loved watching our dividend payers rocket to the moon these past few weeks. Best part is, most of the market has been onboard:

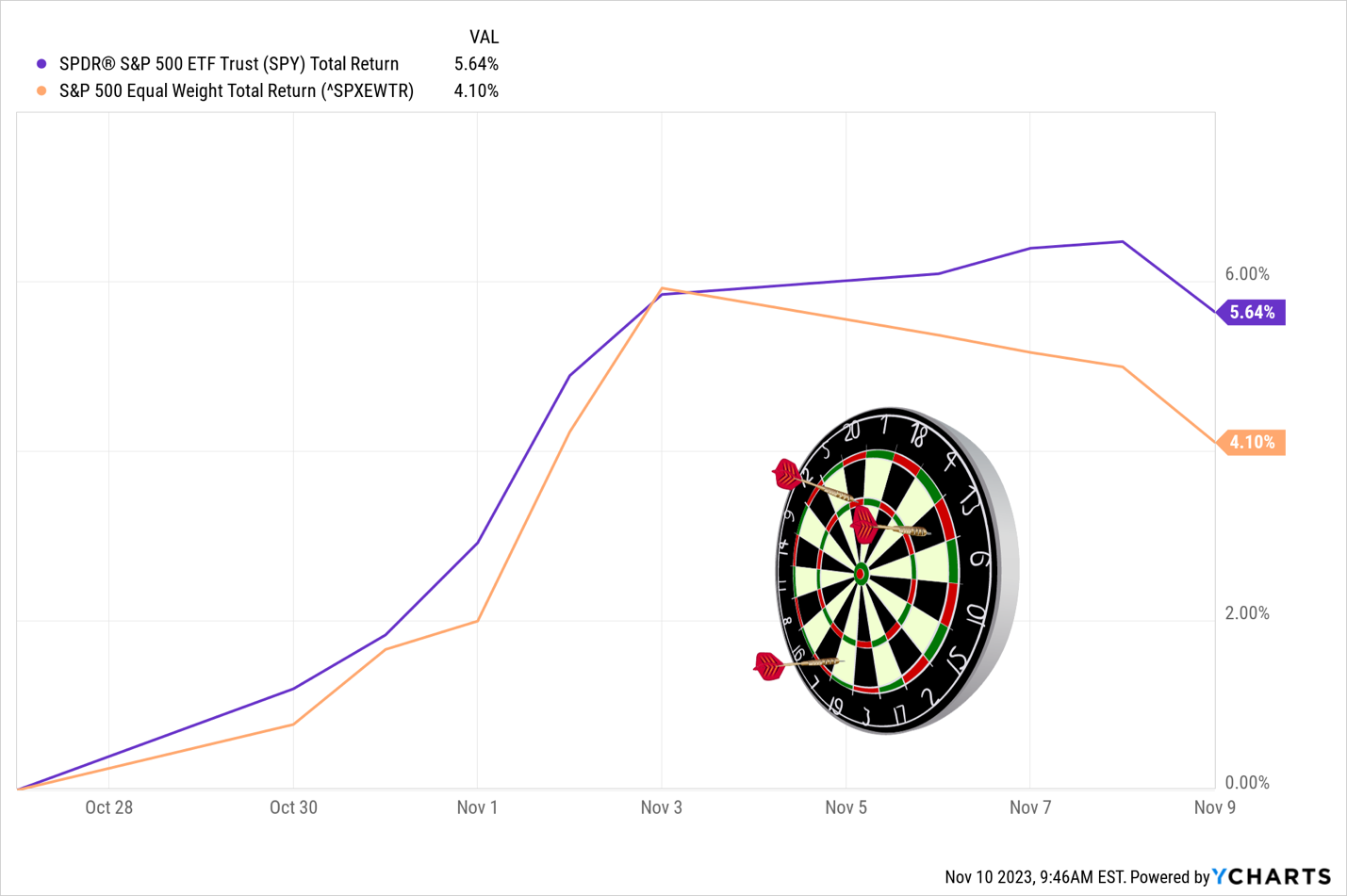

Everyone Wins in This “Close Your Eyes and Throw a Dart” Market

Here we can see the jump in the S&P 500 as a whole (in purple) versus its return on an equal-weight basis (in orange). Sure, there’s a bit of a gap, but safe to say this has been an across-the-board surge.

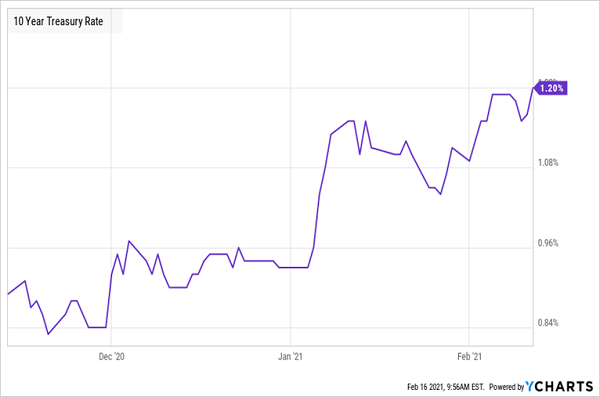

We can (in a backhanded way!) thank Jay Powell—just as he hinted that high Treasury yields were doing the Fed’s work for it, the bond market (figuratively) flipped him off … and Treasury yields plunged from 5% to around 4.6% now.… Read more

Recent Comments