Let’s talk about the cheapest dividend payers in the world. With respect to cold hard cash flow.

We contrarians are too savvy for P/E ratios. We know that earnings are accounting creations. “Profits” are all fugayzi.

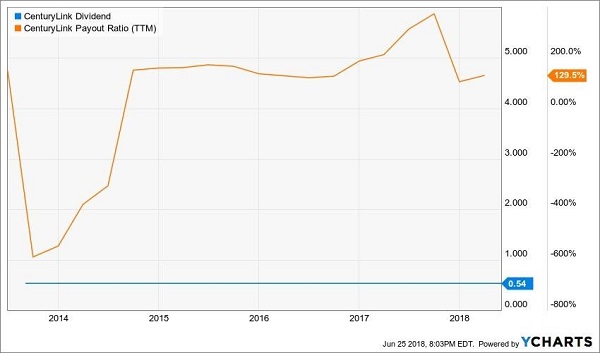

Free cash flow (FCF), on the other hand, is what it is. The cash a company brings in, minus capital expenditures. This cash can be reinvested in the business or, better yet, paid out to income investors like us.

We like companies that dish dividends because their businesses are running on relative autopilot. They needn’t plow every dollar they raise back in. Which is great—more yield for us.… Read more

Recent Comments