The retirement-income battle never ends! In 2020 and 2021, we were terrified of dividend cuts. Now we’re sweating soaring inflation!

The good news? No matter what the worry, we can apply my “2-step retirement income plan.” It’s designed to keep anything Jay Powell, Vladimir Putin or even Chinese President Xi does from impacting our dividend streams.

(Below I’ll give you two tickers that work perfectly with this strategy, including one that profits from the demise of Russian oil. This unsung company just hiked its payout 50%.)

Inflation Sideswipes Retirees

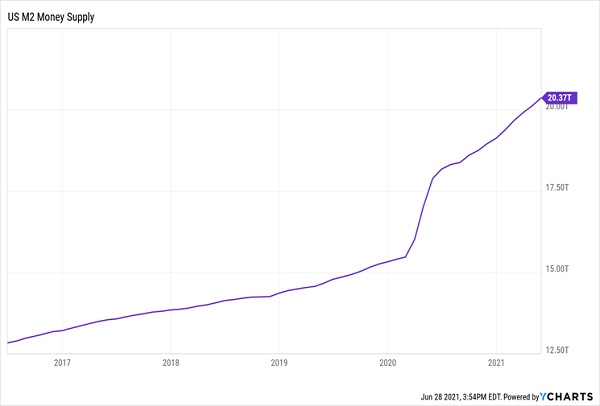

Of course, this market crash is mainly the work of Powell, who overshot the mark on stimulus, boosting the money supply by a ridiculous 40% since February 2020.… Read more

Recent Comments