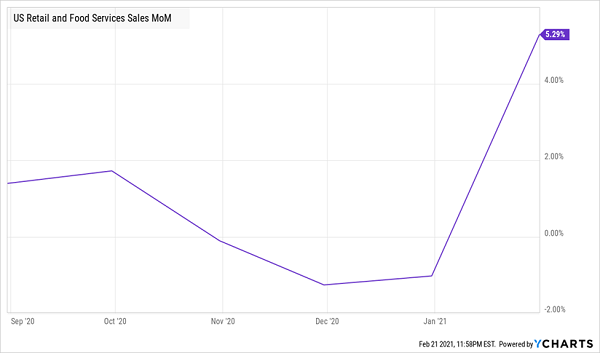

Investors are way too pessimistic about the economy. And their gloom—driven by the mainstream press (as usual)—is setting us up for a rare “double discount” on closed-end funds (CEFs) throwing off 7%+ yields.

I say “double discount” because almost everyone is misreading some of the latest economic signals—and it’s causing them to sell stocks (and CEFs!) at exactly the wrong time.

That mistake—which is behind a large part of the drop we’ve seen in the markets since the start of the year—is discount No. 1.

And we’ll get discount No. 2 by shopping for CEFs that are also trading at undeserved discounts.… Read more

Recent Comments