I don’t want to be the messenger of bearish news to kick off the new year. But, as a card-carrying contrarian, I can’t help it either.

We should sell our dicey dividends now. While the market is high.

The best time to buy was October, when vanilla investors were fearful. We discussed “backing up the truck” to buy anything and everything week after week after week.

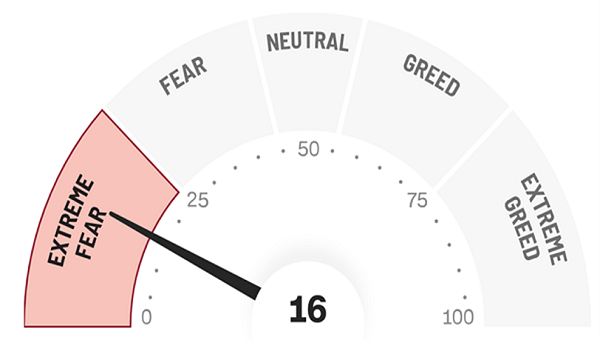

CNN’s Fear and Greed Index (FGI) had bottomed out at 16 out of 100, an Extreme Fear reading only seen during stock market panics:

1 Rally and 3 Months Ago: Extreme Fear

Meanwhile the bastion of basic financial thinking, MarketWatch.com,… Read more

Recent Comments