Tariffs. Inflation. Soaring interest rates. The financial press, of course, blares about all of them—day in and day out.

Truth is, they have to do this to get your attention. But it’s also unhealthy to your portfolio, as investing based on the headlines leads to traps like trading too much, selling at the bottom and buying at the top.

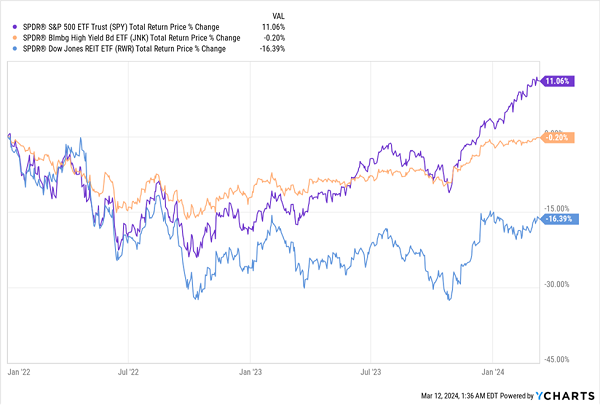

(This, as members know, is why we focus on high-yield closed-end funds and aim to hold long term. This lets us tune out the headlines and “automatically” reinvest our 8%+ average payouts in corners of our portfolio that are on sale at any given time.… Read more

Recent Comments