There’s a disconnect setting up in the energy market that’s a flashing yellow light for investors—particularly if you’ve been playing high-flying oil stocks in 2022.

That would be the fact that oil stocks have become “unhooked” from the underlying oil price, as you can see below:

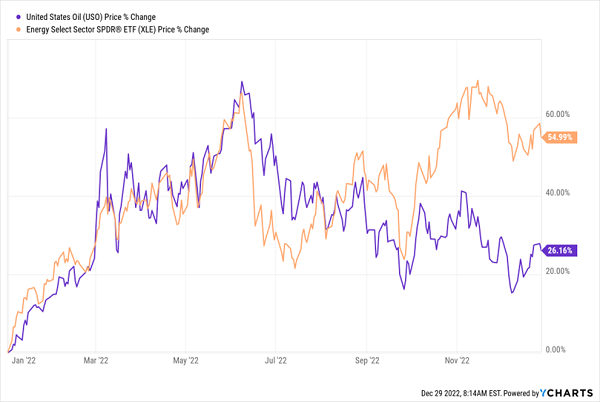

Oil Stocks Zig, Oil Prices Zag

The purple line is the United States Oil (USO) ETF, which tracks the price of light, sweet crude delivered to the distribution hub at Cushing, Oklahoma.

The orange line is the Energy Select Sector SPDR ETF (XLE), a proxy for oil stocks, with big-cap names like ExxonMobil (XOM), Chevron (CSX) and Marathon Petroleum (MPC) among its holdings.… Read more

Recent Comments