With earnings season in the rear-view and the end of the first quarter looming, you’re probably asking yourself one thing right now…

… just how good is the stock market?

I’ll give you the answer (which I think you’ll like) in a moment.

Then I’ll show you 2 funds whose portfolios are packed with familiar stocks, including Apple (AAPL). Both funds are poised for strong gains in 2018 while handing you fat cash payouts up to 8.8%!

Finding Bargains in a Surprising Place

First, if you’re like most folks, you might feel queasy about any stocks—including “reliable” blue chips—after the stomach-churning drops we suffered in February.

If so, let me put your mind at ease.

For one thing, keep in mind that the S&P 500 is up 2.1% for 2018—and if you annualized that growth, you’d see a 12% rise for the full year. I don’t know about you, but I’d happily take a 12% gain, given that stocks already rocketed 25% higher 2017!

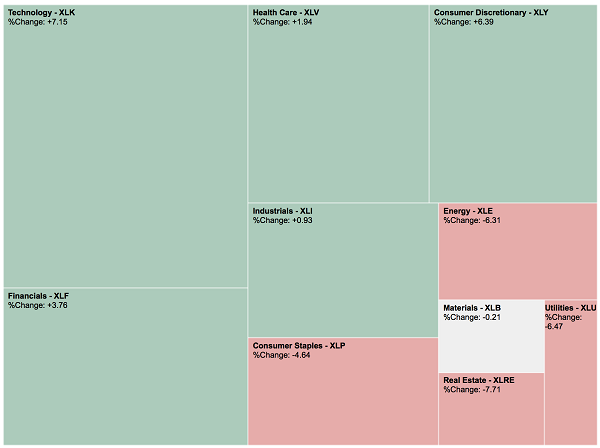

But not all sectors are sharing in the gains, and that’s, well, normal in a healthy market. This year, we’re seeing so-called “safer” sectors, like utilities and consumer staples, fall well off the pace, while their “risky” cousins, like tech, take flight.

Tech Leads, Utilities Flicker

I know what you’re thinking: that the red sectors in the heat map above are probably the best place to go bargain hunting right now.

But we’re going to go the other way—and zero in on incredible deals in the highest-flying sector of all: technology.

I know. Sounds like a tall order, right?

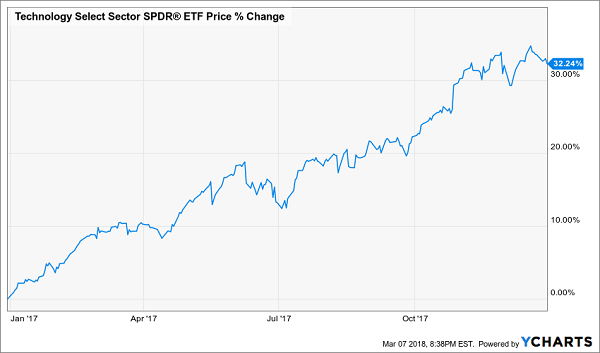

Tech, after all, has very high P/E ratios, which instantly turn off value investors. What’s more, tech is the strongest sector of 2018, even after doing this in 2017:

Tech Bull Keeps Running

But will the strength in tech and other “riskier” sectors continue?

All signs point to yes.

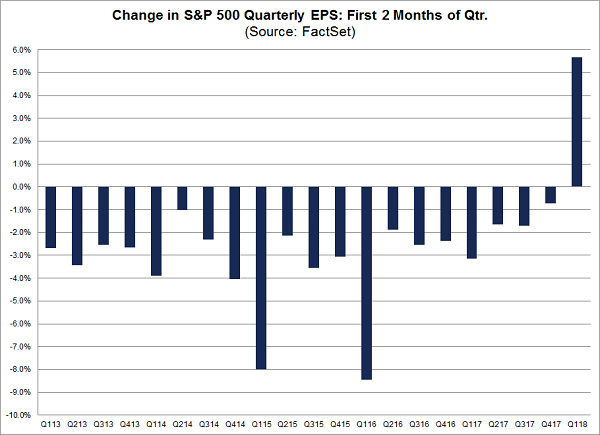

FactSet says that first-quarter S&P 500 earnings per share (EPS) estimates are up 5.7% from the prior quarter. This isn’t just a sign of growth, it’s incredibly unusual. As you see in the chart below, EPS estimates have gone down in the first two months of every single quarter since 2013.

If earnings estimates rise broadly, it’s good for all sectors. Plus, estimates are also rising in technology and finance, which have seen their earnings rise by double digits from a year ago, on average, at the end of 2017. These sectors are typically avoided in times of fear. So with tech earnings soaring and stock prices buoyant, there’s little reason to fear much of anything.

The Income Angle

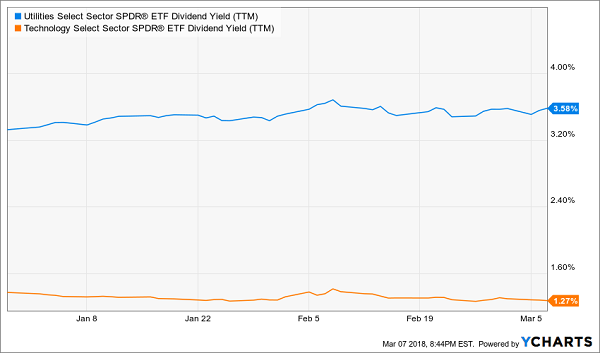

For income investors, this strength in sectors like tech is nice but ultimately disappointing. That’s because dividend fans typically look to cash generators like utilities for the high yields they get back on their investment.

Check out the yawning gap between the payout on the benchmark Utilities Select Sector SPDR (XLU) and the Technology Select Sector SPDR ETF (XLK):

Where the Dividends Are(n’t)

Trouble is, ignoring traditional growth stocks and focusing only on high yielders can sometimes hurt your profits.

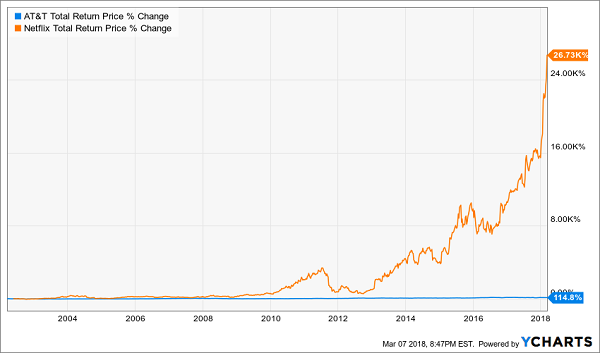

Consider, for instance, an investor who chose AT&T (T) over Netflix (NFLX) because AT&T pays out a 5% yield, vs. the 0% you get from Netflix. Here’s the difference in performance between the two:

The Cost of Ignoring Growth Stocks

So what are dividend hounds like us to do?

Simple: grab both high cash payouts and quick double-digit gains!

We’ll do it through 2 tech-focused closed-end funds that let you tap the sector’s strong growth and pocket 7%+ dividend yields, too.

You can read all about CEFs in my easy-to-read primer here. But the bottom line is this: with CEFs, you get a pro at the helm, using their expertise to make investments in companies set to grow—and handing us a generous income stream while they do.

Tech CEF Pick No. 1: A 5.3% Payer Doing the “Impossible”

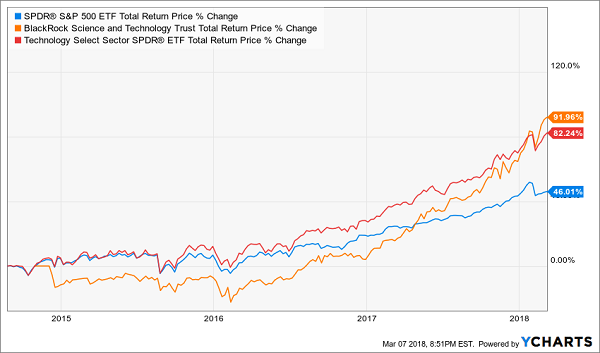

To see what I mean, consider the BlackRock Science and Technology Fund (BST), a CEF I analyzed on March 5 and have been a fan of for a long time.

BST pays a 5.3% dividend, which is 4 times more than you get from the average tech stock. Plus it also has an excellent portfolio of some of the best tech companies out there, including Alphabet (GOOG) and Microsoft (MSFT).

Oh, and it’s crushing the S&P 500 (blue line, below) and the Technology Select Sector SPDR ETF (red line), too.

Income or Growth? You No Longer Have to Choose

That’s right, not only is BST beating the S&P 500, but it’s outperforming the tech index fund, too, something a lot of people will tell you can’t be done (don’t believe them; BST has been doing it for years).

Tech CEF Pick No. 2: An 8.8% Dividend From Your Favorite Techs

Want even more income?

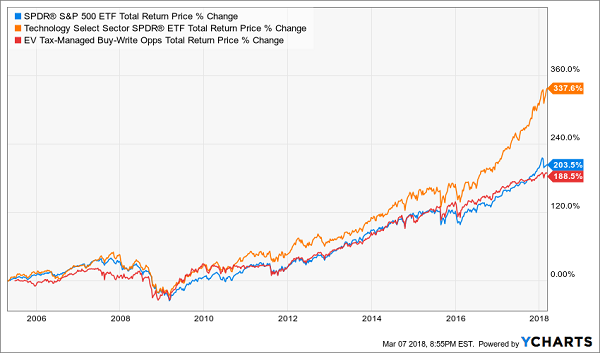

Try the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV), whose top 25 holdings are mostly made up of tech and biopharma stocks (Apple is its No. 1 investment). This fund pays a more generous 8.8% dividend yield, but you will pay a price for that payout: long-term performance.

ETV Focuses on Cash

While ETV’s return is close to that of the S&P 500, it’s behind the tech sector as a whole. There are a couple reasons for this: first, ETV has focused on other areas besides tech. Second, its bigger cash payouts mean it keeps less money to reinvest, so compound returns aren’t as great.

That doesn’t mean ETV isn’t worth buying. If income is your goal, it’s a worthy contender, especially now, since it tends to outperform the S&P 500 but currently trails it slightly. That may reverse, which would hand you capital gains on top of that hefty 8.8% cash stream.

4 MORE “Unicorns” Paying 8%+ and Ready to Rip Higher

Here’s the best news: the wealth-building power of CEFs goes way beyond technology.

In fact, there are more than 500 CEFs out there specializing in everything from real estate to foreign stocks, preferred stocks and bonds.

Funny thing is, most folks have no idea this “secret” market even exists. You never hear about CEFs from the cable TV pundits, and few big-name billionaires go near this hidden pool of cash-spinning funds.

Why?

Because the CEF market is tiny, with every CEF in existence holding a combined $290 billion in assets. That’s just 32% of Apple’s market cap!

Therein lies our opportunity. Because these funds’ low profile sets the stage for fantastic bargains!

The best place to start? With the 4 incredible funds I just named in a new FREE report I’ll GIVE you when you CLICK HERE.

These 4 off-the-radar funds invest in real estate, corporate bonds, US and international stocks (and yes, you’re getting some nice tech exposure here, too).

Throw them together in a single portfolio and you get unbeatable diversification—which keeps your nest egg safe—and an average dividend yield of 7.6%, with the highest-yielder among them throwing off a fat 8.1% CASH payout!

That’s just the start, because all 4 of these unsung cash machines trade at BIG discounts to the value of their underlying portfolios.

Translation: You’re looking at easy 20% upside—at least—in the next 12 months as those weird discounts revert to normal. That’s on top of the 7.6% average yield you’re getting, too!

Don’t miss this opportunity to tap the explosive dividends and HUGE gains only CEFs can deliver. CLICK HERE to grab your FREE Special Report and uncover these funds’ names, tickers and my complete research now.

Recent Comments