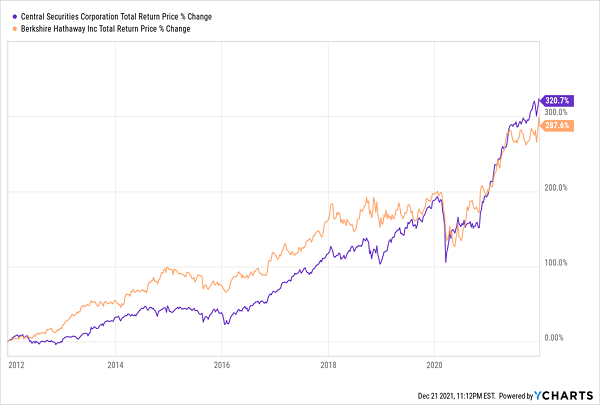

When choosing between closed-end funds (CEFs), you might be tempted to put a lot of focus on fees. That makes sense. Nobody likes high costs eating into their returns.

But there’s more to CEF performance than just the expense ratio, and if you focus on buying the funds with the lowest fees, you might leave a lot of money on the table.

Because the truth is, there’s no clear relationship between fees and long-term returns. A CEF’s portfolio and the skill of its managers play a far greater role in determining its success than fees alone.

Breaking Down the Data: No Simple Relationship Between Fees and Returns

Let’s start with the data.… Read more

Recent Comments