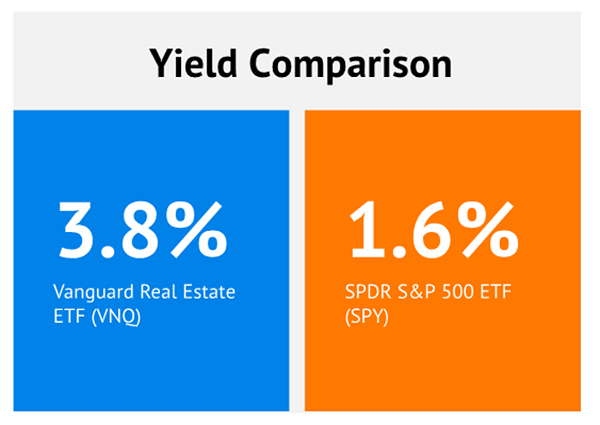

Small dividend stocks are dirt cheap right now. I’m talking about stocks trading for less than one year’s worth of sales. Yields up to 14.7%. And single-digit P/E ratios.

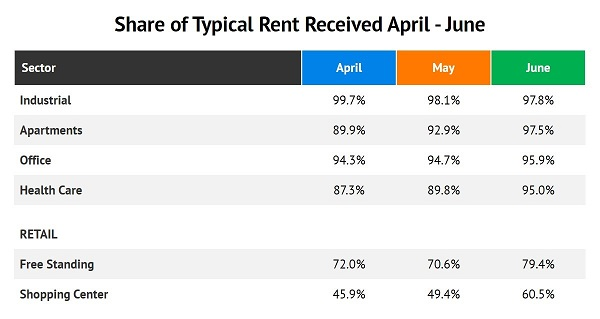

Why such deals? Well, because they’ve been pummeled into bargain territory of late. A number of high-yield bargains are staring us right in the face.

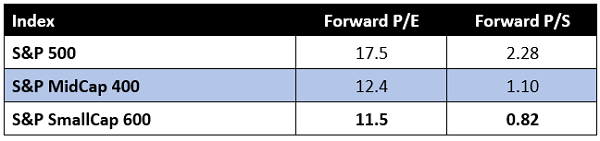

Small firms, straight up, are the cheapest stocks on the planet right now:

Value is great but show us the money! We’ll do so with five small-caps averaging a stellar 12% in yield among them. Are these deals or are these equities cheap for a reason?… Read more

Recent Comments