If retirement gets any better than monthly dividend payers then, well, I don’t want to know about it.

Seriously. I’m a simple guy! Pay me every 30 days and I’ll smile and shut up.

And I’ll grin even wider when my monthly dividends add up to 8.7%, 14% or—get this—19.5% per year.

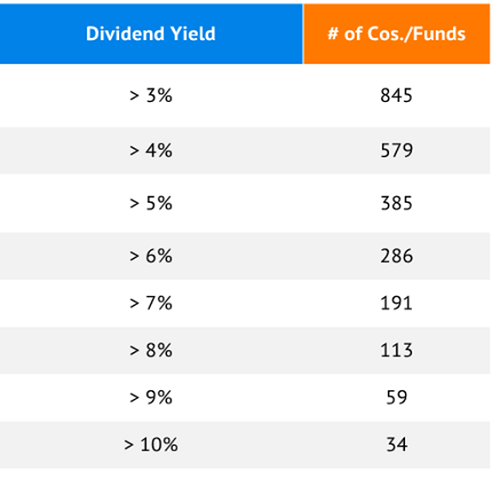

These are not typos. They are real yields from actual stocks and yes, they are spectacular. We’ll highlight them in a moment. But first, let’s review the magic of monthly dividends.

Bills keep showing up every month. Active paychecks from our jobs do not, which is why we rely on payouts.… Read more

Recent Comments