Worried about the trade war and your retirement portfolio? Then I have two words for you: monthly dividends.

Today we’ll fawn over four monthly payers that yield up to 17.4% annually. That’s no typo. Hop in my favorite income vehicle and we’ll motor over this market carnage together.

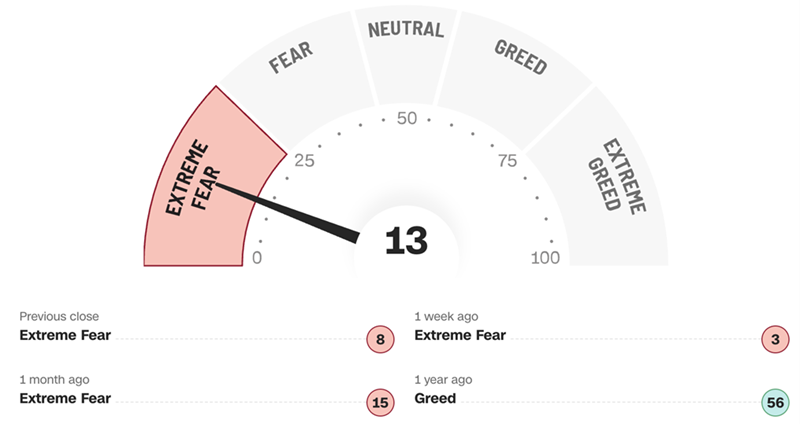

The current market environment is nearly perfect for contrarians like us. How is that possible with tariff policy still, ahem, unfolding? Well the market is still full of fear and the weak hands have washed out.

If Everyone Wants to Panic-Sell to Us, We Should Let Them!

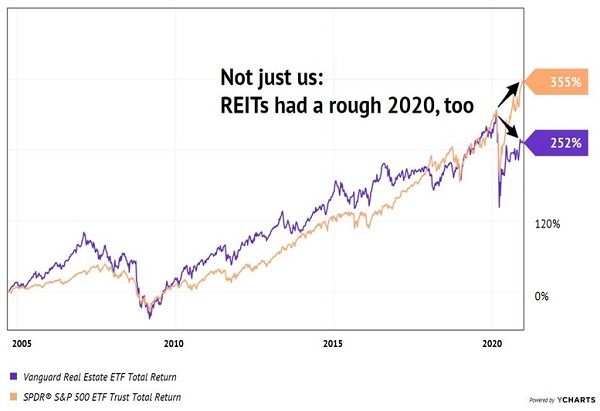

If you’re worried that the fear is justified because we are heading for a recession, let’s consider defensive stocks.… Read more

Recent Comments