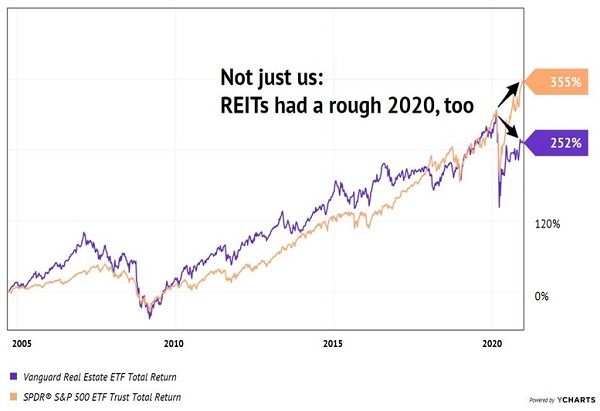

If you’re as nervous about the 2022 edition of the stock market as I am, we should take this holiday week to review reliable REIT dividends.

REITs (real estate investment trusts) are stocks that dish 90% of their profits as payouts. This makes them ideal income plays for retirees. Rather than buying shares and “hoping” they’ll go up, we can lock in quarterly (or even monthly!) dividends—real cold cash!—with REITs.

For example, my favorite REIT for 2022 yields 4.9%. This equates to $4,900 per year on a $100K position, a great start to the year. Plus, we have the opportunity for price gains—for a total return of 10% or so.… Read more

Recent Comments