How would I invest a chunk of money today? Say $10K or even $100K?

I’d load up on dividend magnet stocks, sit back and watch Fed Chair Jay Powell pump them to the moon!

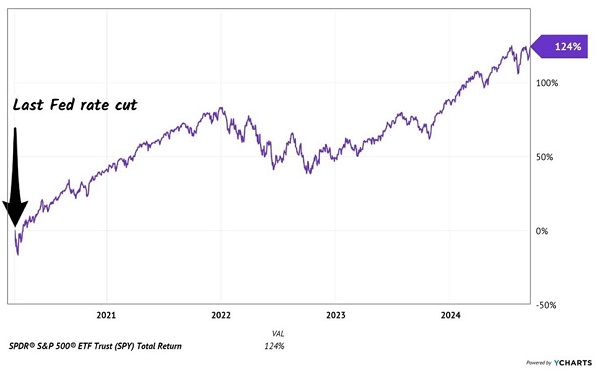

Want to know what happened the last time the Federal Reserve cut interest rates? The broader market soared 124%! Powell printed so much money that the stocks popped:

Last Fed Rate Cut: Stocks Soared 124%

Today, select dividend stocks are set up for 124%-like returns too. Buying them now is the best way to build wealth. And protect ourselves from inflation.

Yeah, the last time Powell printed money, inflation followed for the first time in 40 years!… Read more

Recent Comments