We contrarians, we’re not ashamed to admit, make our big money dumpster diving for discarded dividends.

When vanilla investors toss trash, it is often our treasure!

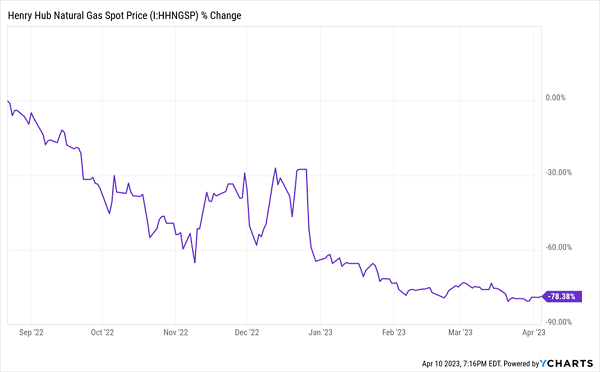

I have a hunch this is unfolding in the natural gas market. Prices literally can’t go much lower, which means that eventually they must go higher. Check out this chart—prices are down by 80% in one year!

Nat Gas is Dirt Cheap

“Natty” prices have fallen from roughly $9 per million British thermal units (MMBtus) to a little more than $2, flattened by unseasonably warm weather and months of dogged supply surplus. Reuters reported in February that “depletion so far this heating season has been around half the seasonal average for the last 10 years.”… Read more

Recent Comments