Is there anything better than a true bond bargain? I mean, feed me those monthly dividends with a side of price upside and I’ll never ask for anything more!

Gains from a bond fund? Yes, we contrarian income investors want it all. And we can have it when we buy funds yielding up to 9.4% at discounts up to 12%.

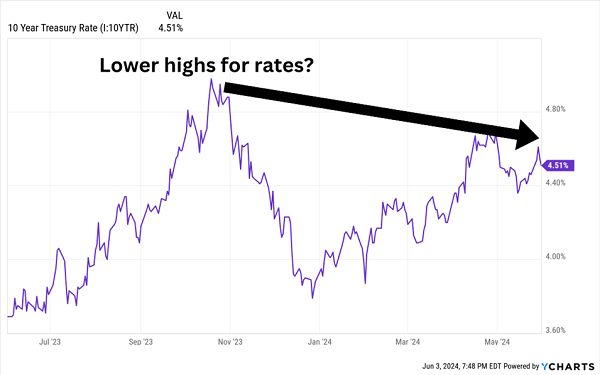

Mr. and Ms. Market are finally realizing that rates did not eclipse their 2023 highs. In fact, they appear to be putting in a lower high, which would be quite bullish for the bonds that Wall Street has been ironically panning all year:

Reality Check: Rates Still Lower Than Last Year

And what’s good for bonds is also good for one of my favorite income investments: the preferred stock.… Read more

Recent Comments