Need more dividend yield in 2025? Consider real estate investment trusts (REITs), which were literally mandated to be dividend-paying machines. Income is the point—by law.

Select REITs even yield 10% or more. What a payout! We’ll discuss seven of them—and their prospects for 2025—in a moment.

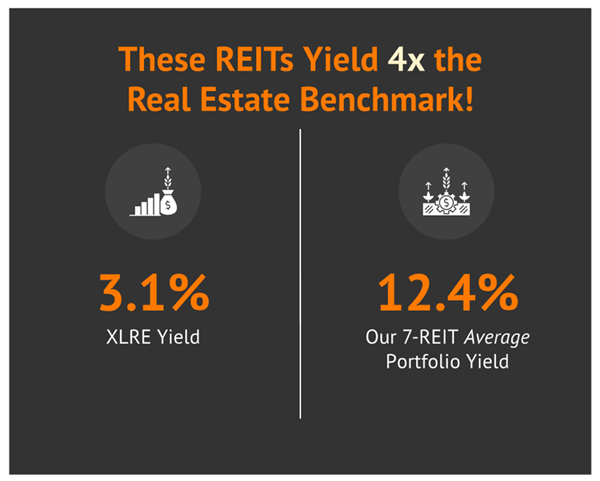

Now we can’t just blindly pick any ol’ a REIT. The real estate sector—using the Real Estate Select Sector SPDR (XLRE) as a proxy—only pays 3% right now.

But the average yield among this REIT 7-pack is 12.4%. That’s 4x what the sector pays!

That level of income would easily allow us to retire on dividends alone.… Read more

Recent Comments