Well the “index huggers” hurled their positions quickly, didn’t they! Some bad jobs numbers. A rally in the Japanese yen. And it was sayonara, SPY.

The financial “squares” use blunt instruments. When they panic, they dump the only ETF they own. Turns out they were all short the Japanese yen heading into the weekend!

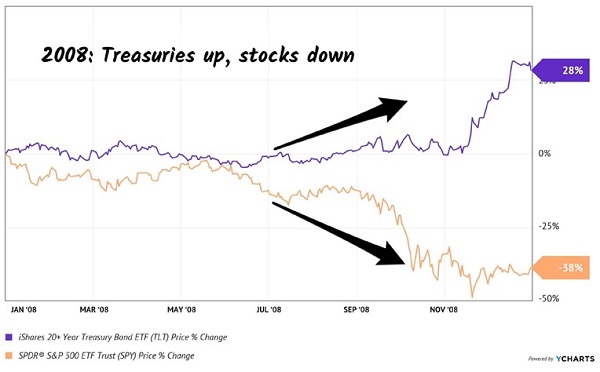

When the margin call came, they sold the only ticker they own: SPDR S&P 500 ETF Trust (SPY).

I warned you about SPY three weeks ago, just before it crashed. My problem with SPY came down to three stocks, Apple (AAPL), Nvidia (NVDA) and Microsoft (MSFT), which made up 21% of the index—and still do!… Read more

Recent Comments