We contrarians love a beaten-up corner of the market—especially these days, when cheap stocks (and funds) are so thin on the ground.

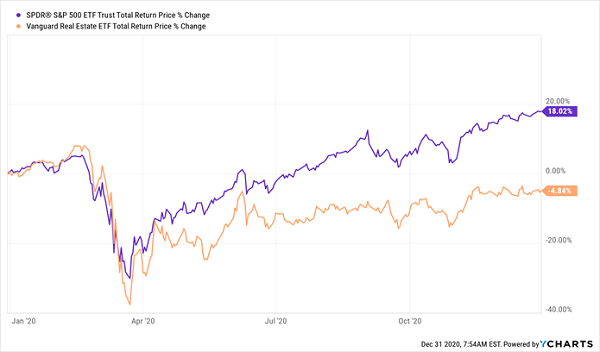

Right now, real estate investment trusts (REITs) are that corner of the market: unloved, cheap and boasting high, stable dividends. And they have even more appeal with interest rates stabilizing and likely to move lower over time.

We’re not taking advantage of this opportunity by purchasing our REITs individually or through an ETF, though. Instead, we’re looking to REIT-holding closed-end funds (CEFs). These income machines, kicking out 8%+ dividends, are no less than my top contrarian income plays for 2025.… Read more

Recent Comments