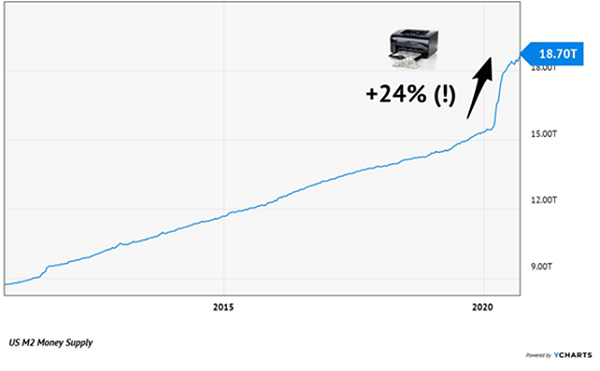

Forget the latest blather from the Fed: folks just trying to get a decent income stream are still getting a raw deal these days. Treasuries pay 3.7%. Stocks? Just 1.6%.

Too bad inflation is at 4%, so our real returns are negative on both!

Sure, stocks do give us price upside, but we have to sell to get a decent income stream, shriveling our portfolio and our dividends as we do.

We can do better with high-yielding closed-end funds (CEFs). These days, plenty of CEFs yield 10%+. The three we’ll cover below do even better, yielding 11.1% on average. That means these CEFs are beating the S&P 500’s historical return in dividends alone.… Read more

Recent Comments