Vanilla investors are freaking out that Jerome Powell & Co. won’t cut rates right away.

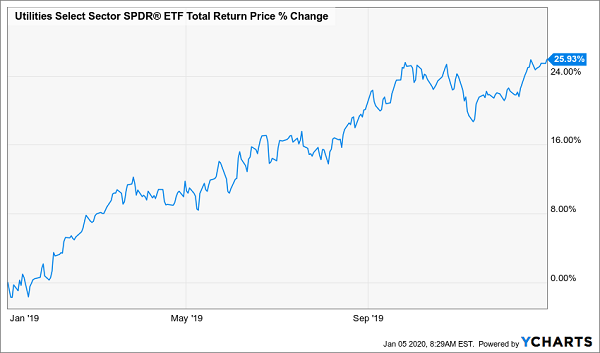

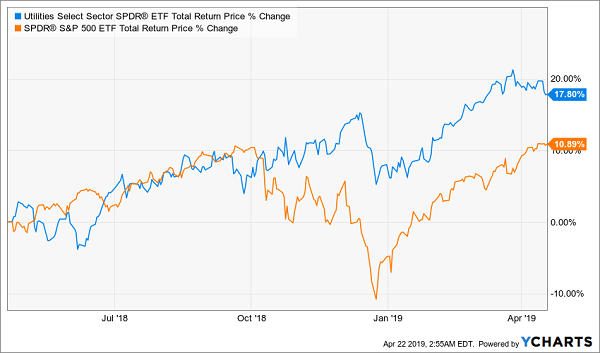

Who cares if we’re buying safe yields up to 11.0% like the three we’re about to highlight. This trio is positioned to benefit from an upcoming bull run in utility stocks:

“To be sure, long rates might hover around these levels for a bit. But the Fed’s rate hikes will eventually add up, and the much-talked-about recession will arrive. That will result in lower interest rates, both on the ‘short’ end (controlled by the Fed) and the ‘long’ (determined by the 10-year Treasury rate). As rates fall, the prices of bonds and ‘bond proxies,’ like utilities, will pop.”

Recent Comments