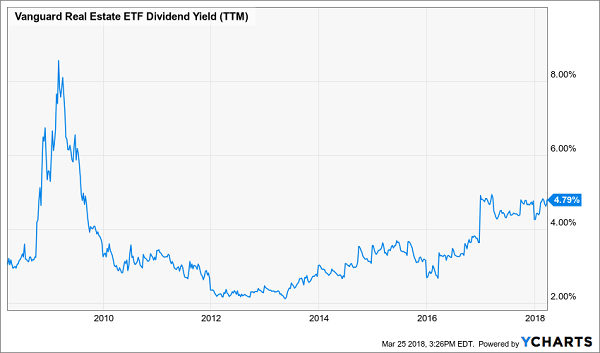

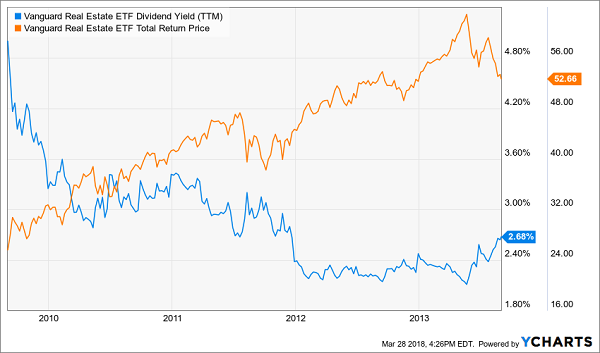

Real estate investment trusts (REITs) are great potential fits for any modern retirement portfolio. With interest rates ticking down from 2% to 1% and, perhaps, eventually 0%, these generous dividend payers are benefitting big time.

REIT stocks tend to yield twice as much as regular ol’ stocks. They collect rent and pay it directly to their investors as dividends. This “capital light” approach gives them cash cow status. It’s a big reason why REITs outperform the broader market over any length of time.

So should we just buy the biggest, most successful REITs and enjoy their dividends and the growth of their payouts.… Read more

Recent Comments