Seriously. Alerian MLP ETF (AMLP) pays a dividend that is now a sizzling 8.2% (read: eight-point-two). Plus, the fund raises its payout regularly. It dishes 12% more today than it did twelve months ago!

As a result, AMLP is so popular that investors keep the price up!

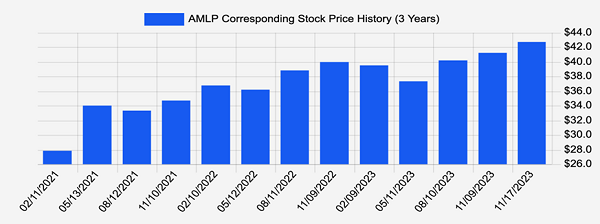

Seriously, check out this quarter-ending stock price chart. AMLP’s quote may drift for a quarter, or two, max. That’s why any meanderings lower are great buying opportunities:

Source: Income Calendar

AMLP is up 19% since we added it to our Contrarian Income Report portfolio just over a year ago. Despite this stellar performance by an income stock, it may indeed be the one missed by most plain-vanilla investors.… Read more

Recent Comments