Look, I get it: many folks love ETFs, mainly because of the cheap management fees.

I mean who doesn’t love a deal? And it is true that ETFs’ fees are a fraction of those levied by the typical mutual fund or closed-end fund (CEF).

Trouble is, most ETF buyers get exactly what they pay for! Some of the worst performers in ETF-land are dividend-growth ETFs, which sound like a nice “1-click” way to load up your portfolio with soaring payouts.

Too bad they can’t stop tripping over their own feet!

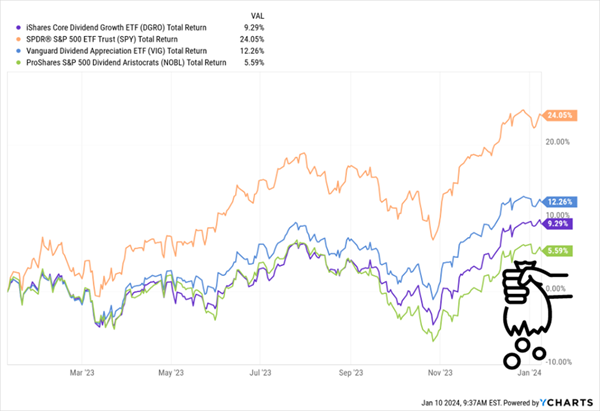

Look at how three major dividend-growth ETFs, the iShares Core Dividend Growth ETF (DGRO), Vanguard Dividend Appreciation ETF (VIG) and ProShares S&P 500 Dividend Aristocrats ETF (NOBL), have fared in the past year:

Stocks Lap Dividend-Growth ETFs

As you can see, the S&P 500 (in orange) blew past this trio, with a 24% total return.… Read more

Recent Comments