This has been a great year for stocks—and a great year for our 8%+ yielding closed-end funds (CEFs), too.

That makes sense: Many CEFs invest in stocks, and many more hold bonds issued by publicly traded firms, so what’s good for stocks tends to be good for CEFs.

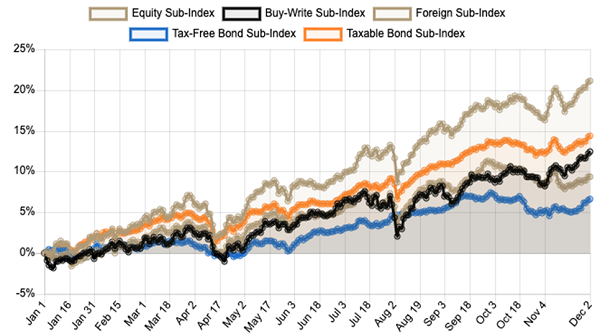

CEFs March Higher in ’24

Source: CEF Insider

When we look at the proprietary indexes we use to track CEFs at my CEF Insider service, we see that the equity sub-index has done the best, with a 21% year-to-date total return. Corporate bonds are second at 14.3%. Municipal bonds, known for lower volatility and risk, have gained a bit less, as you’d expect, at 6.6%.… Read more

Recent Comments