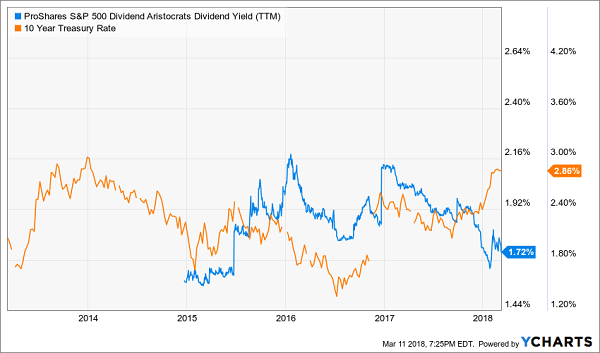

Where are you going to find meaningful income to get you through retirement? Not from popular stocks, with the S&P paying less than 2%. And bonds won’t help either, as their yields are in the tank, too.

Instead let’s consider real estate investment trusts (REITs), which are tailor-made for investors who are at or nearing retirement. Specifically, I’d look to dividend-growing REITs, like the three I’m about to show you. This trio of landlords are on pace to double their dividends in just four years.

How Dividend Growth Can Quickly Double Your Money

Respected healthcare REIT Ventas (VTR) is the perfect example of how this strategy can do more than provide income.… Read more

Recent Comments