Can we income seekers safely get back into REITs (real estate investment trusts) next year?

With the yield on the S&P 500 about to drop to a sad 1.5% (thanks, Tesla (TSLA) addition), renewed REIT-hope sure would be nice! The landlord industry index Vanguard Real Estate ETF (VNQ) pays 3.5%. That’s a dividend oasis in this zero-point-nothing world.

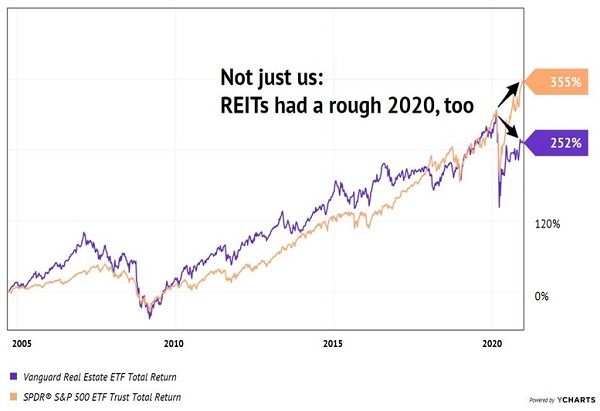

Once upon a time, VNQ performed in-line or better than the blue-chip index. It was a pretty good deal, as you could double your dividend and keep up with the Joneses’ portfolio with less heartburn.

Then, April 2020 came along, tenants stopped paying rents, and REITs-at-large got crushed:

A Good REIT Run While It Lasted

Does the fork-in-the-road above represent a paradigm shift or relative value?… Read more

Recent Comments