If we can say one thing about the rest of 2024, it’s this: We’re looking at a stock-picker’s year here—and folks who try to play it with vanilla ETFs will have a tough time.

Just look at the state of play in front of us.

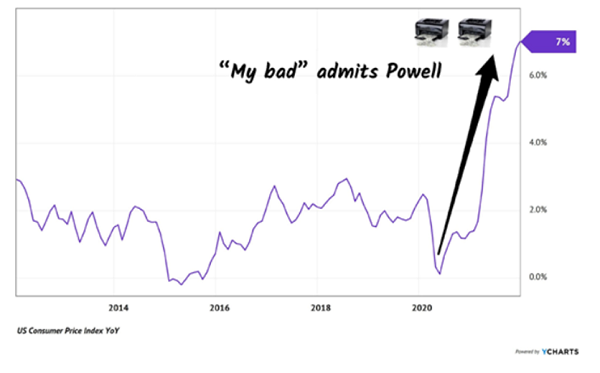

The Fed is trying to thread a needle, and if economic numbers come in too hot or too cold for Goldilocks, well, good luck holding something like the SPDR S&P 500 ETF Trust (SPY)!

In an environment like this, a good plan is to zig when the market zags.

To do so, we’re targeting stocks in the bargain bin with “recession-resistant” strengths such as steady revenue from clients who must buy their services no matter what.… Read more

Recent Comments