It’s starting again—the media has its hooks into a new story to scare investors, in yet another effort to gain attention.

The upshot is that we’ve now got a very nice opportunity to pick up a special kind of closed-end fund (CEF) that yields 7%+ and does something unusual to limit downside.

This setup reminds me just a bit of 2022, when buying fear gave contrarians bargains, and historically high dividend yields, too.

The Media-Driven “Crisis” That Doesn’t Exist

Let’s start to trace out our opportunity here by first talking about the media, which I probably don’t have to tell you is more interested in getting an emotional reaction (mainly fear and worry) out of its audience more than anything else these days.

The scribes’ current fixation? Unemployment.

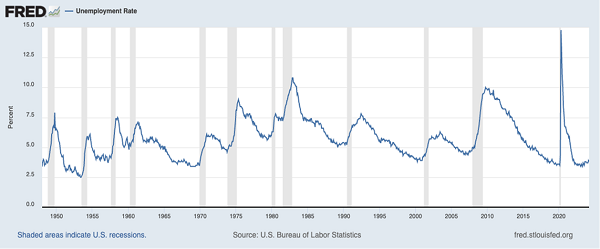

To unpack that a bit, let me first take you back to the dark days of 2022 (only for a moment, I promise!), when media-generated fears prompted the longest bear market in recent memory, even longer than the Great Recession, when unemployment hit 10%.

Compare that to 2022, when unemployment peaked at … 4%. I think you’ll agree that’s a very healthy number, as is our current 3.8% rate.

Low Unemployment Counters Fear-Driven Reporting

In other words, we don’t have an unemployment crisis today, nor did we have one in 2022. But that didn’t stop the media from scaring people into selling stocks back then, causing a crash many economists still struggle to explain.

These days, the media still isn’t buying it. The Wall Street Journal is questioning the current data, pointing out that job numbers don’t include the quality of jobs, so are we just replacing higher-paid jobs with lower-paid ones?

That’s what the WSJ is suggesting. In a recent podcast, they argued that employee sentiment is down because workers are feeling threatened by things like AI. “I certainly talked to a lot of workers who are feeling cynical about the job market, even with these seemingly great stats,” WSJ host Callum Borchers said, adding that a big topic was “… artificial intelligence: a lot of people feel threatened by it.”

Of course, for the tens of millions of Americans who work with their hands and whose work can’t be replaced by clunky robots anytime soon (think carpenters, plumbers, contractors, and electricians), the reporters just sound out of touch. Truth is, yes, robots will take jobs in the future. But it isn’t happening today, or this month, or this year.

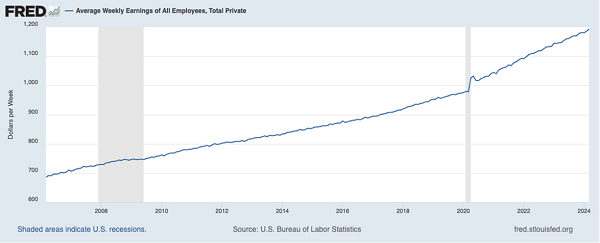

It’s no wonder stocks are ignoring this narrative. In reality, demand for employees remains strong across the economy, and they’re getting paid more, as this chart shows:

Incomes Still Going Up

If employers were replacing high-paid jobs with low-paid ones (using AI or not), average weekly earnings across all employees would go down. But the chart shows the opposite: Incomes are rising faster than we saw in the 2000s, up 24% on average in the last five years versus 11.9% in the prior five years (2015 to 2019).

In other words, things are, on the whole, going well for workers. And workers are consumers, of course, which means things are going well for the US economy.

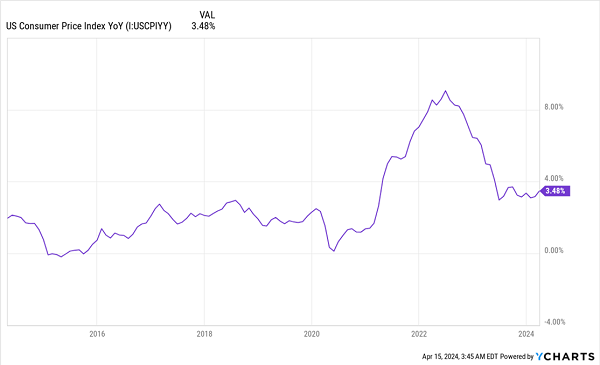

But this brings up another question: Are things going too well? If many people are getting good jobs and high incomes and they spend too much, won’t prices soar?

Inflation: The Other Big Fear

Inflation was a big worry in 2021 and early 2022, but it has slowed to 3.5%, where it’s been stuck. Of course, the media tried to gin up fears over this, with CNBC saying “Surging inflation fears sent markets tumbling and Fed officials scrambling.” That “tumble” means the S&P 500 is up 7.5% in 2024, and we’re only in April!

It’s clear that strong price growth in 2021 and 2022 has ended. And while inflation should be lower, it isn’t dangerously high. This is not something to sell over.

A 7.7%+ Payer That Offers S&P 500 Exposure, Lower Volatility

Of course, the market could still panic in the coming weeks. With that in mind, you could get a bit of insurance with a covered-call fund like the Nuveen S&P 500 Dynamic Overwrite Fund (SPXX).

SPXX is a CEF that, as the name suggests, holds the stocks in the S&P 500—blue chip names like Walmart (WMT), Johnson & Johnson (JNJ) and Microsoft (MSFT).

That sounds like an index fund, but there are two important differences: First, SPXX yields 7.7%, a lot more than the 1.3% on the typical S&P 500 stock. Second, it sells covered-call options on its portfolio. In other words, it sells investors the right to buy its stocks at a fixed price and a fixed date in the future.

No matter what happens with these trades, the fund keeps the fee it charges—and uses this cash to fund its dividend. It’s a strategy that works great in volatile times.

Moreover, SPXX trades at a 9.9% discount to net asset value (NAV, or the value of its underlying portfolio) today. That means we’re basically getting its portfolio for 10% below what we’d pay if we bought these stocks individually on the market.

Another “Low-Drama” Income Play for Tech Turbulence

If you think more volatility is coming for tech stocks, the Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) performs the same function as SPXX but for the NASDAQ. It currently pays an 8.1% dividend and trades at a 10% discount.

And of course, in addition to collecting their dividends, you’ll benefit if these funds’ holdings dip and then recover.

Consider Volatility Protection, But Don’t Get Caught Up in the Hype

I do think the liquidity these funds offer will be more attractive in the coming weeks if another wave of fear washes over the markets.

But if that happens, please don’t get swept up in the panic like so many did in 2022. They sold at a loss, have missed the S&P 500’s 43% gain since the low and have had no income for that entire time. Patient investors in funds like SPXX and QQQX, meanwhile, are sitting on profits and collecting reliable income streams, too.

The Media’s Wrong About AI, Too (So We’re Buying These 4 Big Dividends)

While SPXX and QQQX are a smart way to play defense, it’s critical that we use this time to go on offense, too.

There are simply too many bargain-priced CEFs out there not to! These include 4 smartly run AI funds kicking out a monster 7.8% average yield between them.

Why We’re Not Buying the Media Line on AI, Either

AI is another area the media gets wrong: Despite what the talking heads say, it’s NOT too late to get in on the gains ahead as AI reshapes the economy. But we do need to pick the right investments—and not just go for “shiny ponies” like NVIDIA (NVDA).

This is where CEFs come in: Not only do the 4 AI funds I’m urging investors to buy now yield 7.8% between them, but they trade at big discounts to NAV, too. That essentially lets us “turn back the clock” on the blue-chip tech stocks these funds own—and buy them at prices we haven’t seen in months.

Now is the time to make our move.

Recent Comments