I’m this close to sending out a buy call on a stock that—if I do—I know would light up the phone lines (and customer-service inbox!) at our New York office.

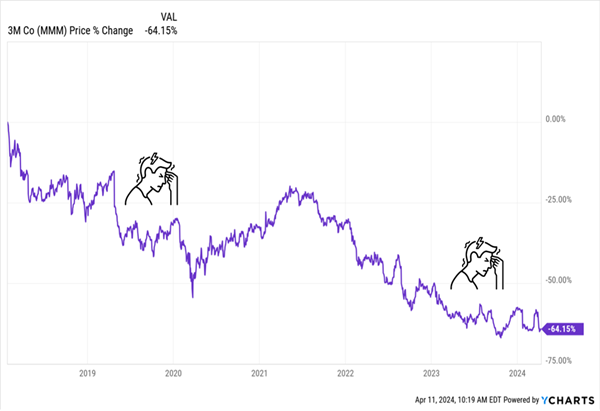

There’s a good reason why: Imagine being along for this drop.

New “Watch-List” Addition Sheds Two-Thirds of Its Value

(Heck, given that this stock was till recently a staple of many dividend portfolios, maybe you don’t have to imagine.)

That’s the peak-to-trough dive on 3M Co. (MMM) in the last six years. To put it in perspective, it came as the broader S&P 500 gained 79%.

I know that buying—or even considering—a stock with a chart like this gives many folks heart palpitations.… Read more

Recent Comments