Let’s talk about five dividends that are set to soar when the Federal Reserve cuts interest rates.

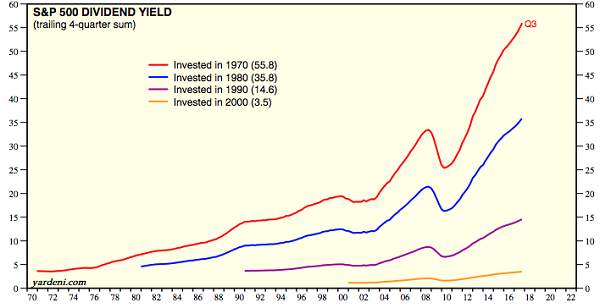

Not that these stocks need help. They are already in multi-year bull runs because they have the power of the “dividend magnet” on their side. This is a situation where dividend growth pulls a stock’s price higher and higher.

Let’s take coffee giant Starbucks (SBUX) as an example. Starbucks has beaten the S&P 500 by more than 300 percentage points since 2010. That’s also the year in which SBUX started paying dividends.

But it’s not just that Starbucks has clobbered the broader market. It’s the way in which the stock price and dividends have largely moved in tandem, with one seemingly pulling the other higher over time.… Read more

Recent Comments