It’s hard to find a hater right now.

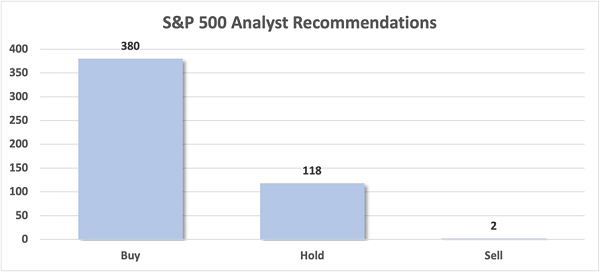

Wall Street fanboys analysts have Buy ratings on more than 75% of the S&P 500 at the moment.

Give us the Sells. That’s right. We contrarians are not afraid to dumpster dive for dividend value!

Today we’ll slam a six-pack of analyst pans yielding between 6.1% and 11.8%. We searched far and wide for these loathed names because, as I write, there are but two blue chips in the Sell bin:

2 Sells Out of 500… What are the Odds!

Source: S&P Global Market Intelligence

Sells are where the party is at.… Read more

Recent Comments