Don’t believe the media’s latest line that stocks—and by extension 7%+ yielding closed-end funds (CEFs)—are oversold.

Far from it!

Truth is, stocks—and bonds and real estate, for that matter—are still oversold as a result of the 2022 market crash.

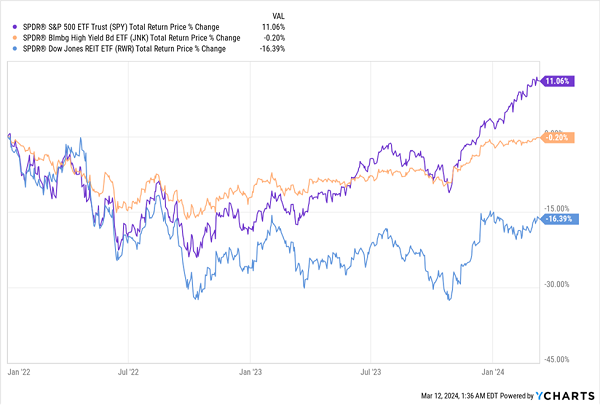

You can see that in action in the chart below, with the benchmark ETF for the S&P 500 (in purple) up 11.1% since the start of 2022, while corporate bonds (in orange) are basically flat. And real estate investment trusts (REITs)—in blue—are still in the tank, down about 16%.

Don’t Believe the Hype: All Our Favorite Assets Are Still Cheap

Fact is, those are all low numbers, even for stocks: the S&P 500 is up an annualized 5.4% over the last two years and change since the start of 2022, which marked the beginning of the market’s swan dive.… Read more

Recent Comments