Small cap stocks should benefit from the new administration. Today we’ll discuss four under $20 with yields between 7% and 15.1%.

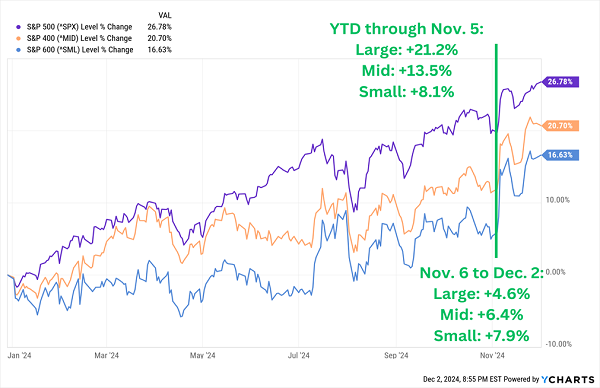

The Trump 2.0 Trade is rolling and small caps are soaring because they are expected to benefit from reduced regulations. Since November 6, the small have become mighty, outperforming their larger counterparts:

Election Flips the Small-Cap Script

Too much too soon? The counterpoint is inflation, which is likely to remain sticky. Which means interest rates will remain higher than Wall Street previously hoped. Higher rates are a headwind for smaller companies, which tend to be debt machines. (They lack the cash flow of the giants.)… Read more

Recent Comments