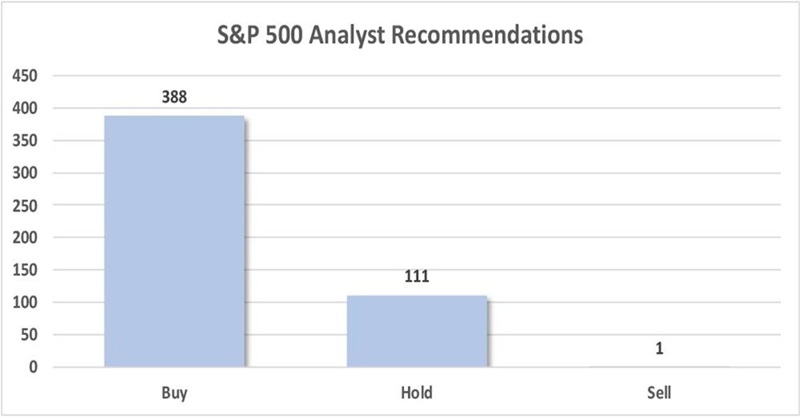

Wall Street analysts have “Buy” ratings on 388 stocks in the S&P 500. That’s over 76% of the index!

Thank you, suits, for the curation. No, seriously. We contrarians are going to comb through the Holds and, even, the lone Sell:

Analysts Rate Most Stocks as “Buys”

Source: S&P Global Market Intelligence

Analyst optimism is the norm. Analysts need access, companies provide them with access. One hand washes the other, thus it is rare to see unfavorable ratings on stocks.

The problem with a Buy rating is that there is nobody left to upgrade the stock. Every delta is a downgrade.… Read more

Recent Comments