We income investors like REITs (real estate investment trusts) because they are obligated to dish most of their profits to us as dividends. Today we’ll discuss five with fat yields between 8.3% and 9.3%.

When to buy REITs can be tricky. Generally speaking, we don’t want to buy them before rate hikes. Higher rates make money more expensive. REITs thrive on cheap money. So, the recent rate hiking cycle has been bad for REITs-at-large.

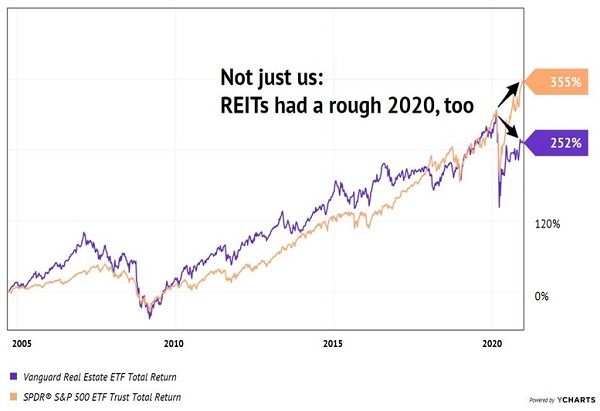

Rates and REITs Moved in Opposite Directions

Rate hikes appear done, which usually means it is time to buy REITs. After all, the Fed’s next move is likely to be a cut.… Read more

Recent Comments