Vanilla investors are freaking out that Jerome Powell & Co. won’t cut rates right away.

Who cares if we’re buying safe yields up to 11.0% like the three we’re about to highlight. This trio is positioned to benefit from an upcoming bull run in utility stocks:

“To be sure, long rates might hover around these levels for a bit. But the Fed’s rate hikes will eventually add up, and the much-talked-about recession will arrive. That will result in lower interest rates, both on the ‘short’ end (controlled by the Fed) and the ‘long’ (determined by the 10-year Treasury rate). As rates fall, the prices of bonds and ‘bond proxies,’ like utilities, will pop.”

And there are better opportunities than individual blue-chip utilities, too. With the right funds, we can buy cheap utes at a significant discount and boost our yields, too.

Our secret is closed-end funds (CEFs). CEFs can trade well below their net asset values (NAV), providing us the opportunity to purchase their holdings for pennies on the dollar. And they can pull various levers (debt leverage, options, etc.) that enable them to yield double, even triple what typical utility funds pay.

As a result, these three funds can generate massive 7% to 11% yields:

Duff & Phelps Utility and Infrastructure Fund (DPG)

Distribution Rate: 9.4%

Here’s a quick lesson in how CEFs can offer far superior yields than their exchange-traded cousins.

A basic ETF can only invest the assets they accumulate. If investors pour $100 million into a fund, management can go out and invest, at most, $100 million.

Not so with CEFs like Duff & Phelps Utility and Infrastructure Fund (DPG). DPG uses a pretty high effective leverage of 29%, which means DPG’s management can effectively invest 28 cents on the dollar more into their portfolio holdings. Or, to complete the example, if the fund collects $100 million, it can actually go out and invest $128 million.

Now, DPG, like other utility CEFs, doesn’t solely invest in the utility sector. Utility stocks are the biggest allocation by far, at nearly two-thirds of assets. But we also get a healthy heaping of midstream plays (25%), as well as sprinklings of infrastructure and even telecom stocks. So, not only will we see the likes of NextEra Energy (NEE) and Duke Energy (DUK), but we’ll also see plenty of master limited partnerships (MLPs) like MPLX LP (MPLX) and Enterprise Products Partners LP (EPD). We get some international diversification too—15% of assets are tied up in developed-market international stocks.

One risk of a fund like this is that a hit to energy could depress MLPs, which in turn could weigh on DPG’s portfolio and negate some of its defensive stance. But energy infrastructure has been on a roll—so what gives?

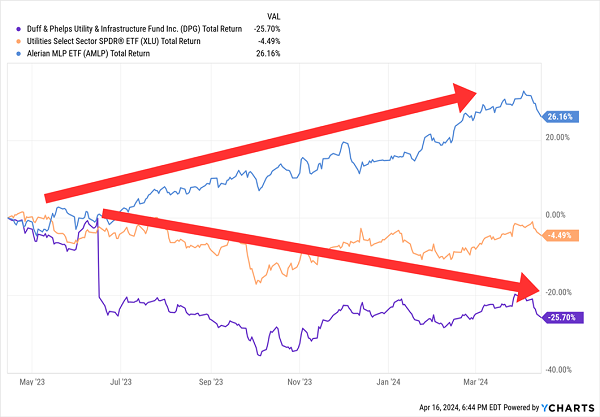

Duff & Phelps’ Performance Has Been Unusually Dim

In June 2023, DPG shares hit the floor because of the flip side of using all that leverage. The fund announced a 40% cut to its September quarterly distribution, from 35 cents per share to 21—a move that “reflects the increase in the Fund’s cost of leverage, current and expected earnings, and overall market conditions.” Rapidly rising interest rates cranked up the costs of amplifying the portfolio’s holdings with debt, and DPG management decided to bite the bullet and downsize to a potentially more sustainable payout.

It was a black mark on what was a dependable distribution program. And shares have still struggled to even tread water since last June.

If there’s a silver lining—at least for would-be buyers—is it widened DPG’s discount to NAV to levels last seen three years ago, and at the bottom of its historical range.

BlackRock Utilities, Infrastructure, & Power Opportunities Trust (BUI)

Distribution Rate: 7.1%

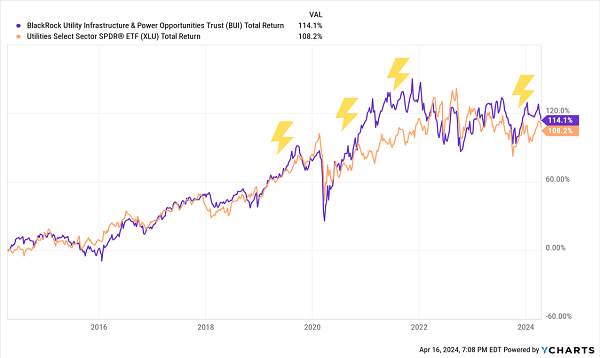

The BlackRock Utilities, Infrastructure, & Power Opportunities Trust (BUI) has been a much more competitive fund—one that has kept its now-monthly distribution intact since it started paying shareholders in February 2012.

BUI differs markedly from DPG in several ways.

For one, it has much less utility exposure. BlackRock’s fund merely has a plurality, not a majority, of its assets in utilities (40%). Capital goods make up a whopping 30% of exposure, followed by energy (11%) and a peppering of other sectors and industries past that.

Also, it’s much more geographically diversified. Currently, U.S. stocks make up less than 60% of BUI’s portfolio. The rest is invested in developed-nation stocks from France (9%), the U.K. (5%) and Italy (5%), among others.

This makes it difficult to compare BUI to a traditional utility fund, but it has largely traded like one. It has a razor’s edge over vanilla ETFs at the moment, and it has produced occasional bursts of outperformance during its history.

BlackRock’s BUI Can Charge From Time to Time

One other marked difference? BlackRock Utilities, Infrastructure, & Power Opportunities barely uses leverage—so it won’t double down on bets, for better or worse, and it means a lower (but still high) yield. It also has meant more stability and less weight on the fund during this period of relatively higher rates.

The headline valuation here won’t blow anyone away, either—BUI currently trades for a modest 5% discount to NAV. But that pricing is more appealing when we consider the fund has averaged a 1% premium over the past five years.

Gabelli Utility Trust (GUT)

Distribution Rate: 11.0%

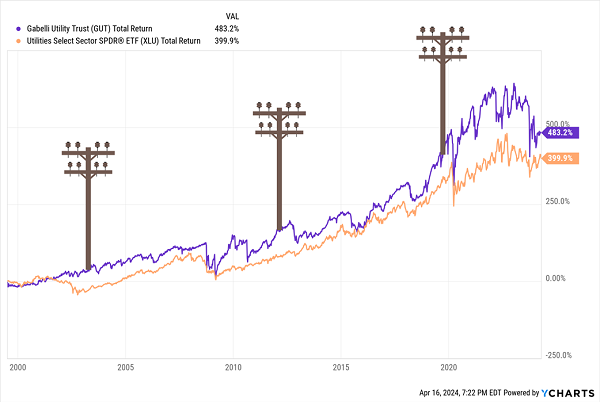

The good folks at Gabelli have put together a utility fund that has soundly spanked its vanilla competition.

More Volatile? Sure. But Results Are Results.

The Gabelli Utility Trust (GUT) is the purest utility play of the bunch, at 70% of assets, but it’s still not wholly exposed to the sector. That’s largely due to how it defines utilities, though (emphasis mine): “Investments will be made primarily in foreign and domestic companies involved in providing products, services, or equipment for the generation or distribution of electricity, gas, water, and telecommunications services.”

Telecoms actually earn a double-digit weight in GUT, and why not? Internet and cellular service might not be on par with electricity or water, but they’ve still become everyday necessities, and the providers have low-growth-but-high-moat businesses that are similar to utilities.

Being a CEF, Gabelli Utility Trust is run by human managers—including GAMCO founder Mario Gabelli himself—and uses a high amount (25%) of debt leverage to provide a little extra oomph to the team’s picks and the fund’s monthly distribution.

There’s just one little problem that’s difficult to ignore:

Look Closely. This Isn’t a Performance Chart.

Much of Gabelli Utility Trust’s recent gains have come not through growth in its underlying holdings, but through an extensive bloating of its premium to NAV. And as you can see, while GUT normally trades at a pretty pricey premium, we have reached largely uncharted territory over the past few years.

We contrarians don’t overpay for stocks because we know that impatiently shelling out a premium now handicaps our gains down the line.

That’s a danger with even a little froth—imagine how behind the 8-ball we’d be if we paid nearly double face value!

Give Me 4 Minutes, I’ll 5X Your Retirement Income

I know you might feel like the only way to lock in a life-changing yield is to stretch your standards and take on more risk than you’re comfortable with. After all, even a couple points of additional yield can translate into tens of thousands of dollars more in retirement.

But as long as you’re patient and disciplined, you’ll never have to sacrifice to earn the level of income you need.

You can get big yields, growth potential, even a bargain price—all without having to worry about what Jerome Powell, or the next election, or a Chinese economic flare-up will do to your retirement nest egg.

I know this because these are exactly the kind of traits you can find throughout my “Perfect Income” portfolio.

Forget timing the market. Forget chasing trends. In my “Perfect Income” portfolio, we simply target high-yield investments (roughly 5x the S&P!) and hold on to them, no matter what the Fed, Congress or the rest of the world throws their way.

So, why do I call these dividends “perfect”?

Well, they must have a few things in common:

- They DO pay consistently, predictably and reliably.

- They DO survive—and even thrive—in market crashes.

- They DO deliver double-digit returns, with safe, secure investments.

- They DO require minimal management time—just a few minutes every month!

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

Recent Comments