Buying a business development company (BDCs) is kinda, sorta like investing like a venture capitalist (VC).

Minus the arrogance. And the lack of yields!

I was 26 when I realized that VCs were just regular guys and gals. Well, let’s be honest—mostly guys. They didn’t necessarily know anything special. But VCs play the part, sitting in their Steelcase chairs and short sleeved polo shirts while it’s 60 degrees out here in Northern California.

BDCs, on the other hand, are investments for the people. Plus, they pay—up to 15% in dividends!

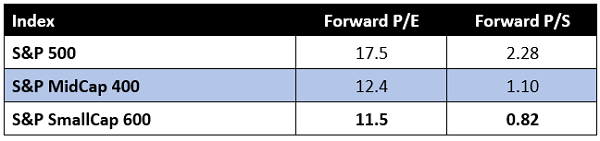

Here’s a quick primer. BDCs lend to small and midsized businesses that the big banks either won’t touch.… Read more

Recent Comments