There are reams of investment strategies out there for maximizing gains in a rising market and protecting ourselves when stocks tumble. But what do we do when markets simply grind sideways?

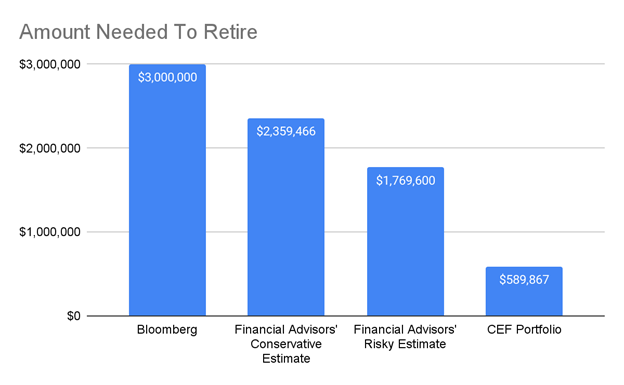

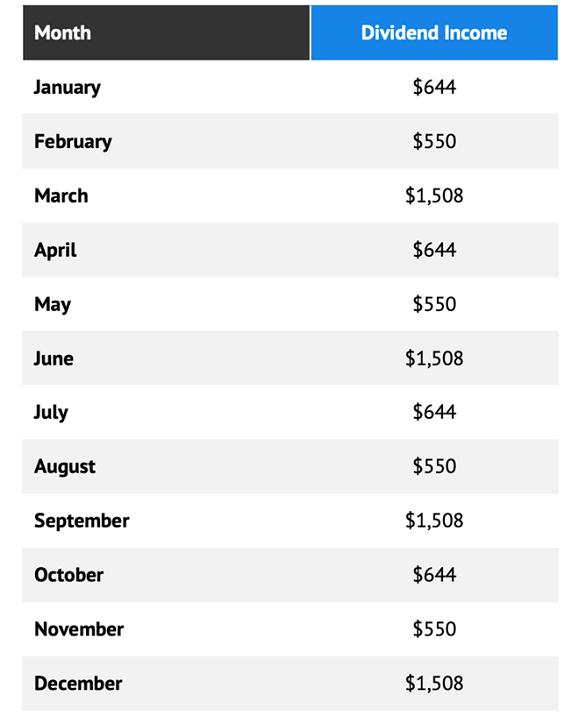

That’s what we’re going to delve into now, with three potential moves. Our favorite of these three involves buying a closed-end fund (CEF) yielding 12.8% with a payout that’s actually grown over the long haul.

September Swoon Not Unusual

So far this year, we’ve seen the S&P 500 come close to recovering 100% of its losses from last year, only to pull back in recent weeks. Even though this has made for a bit of a stressful September, it’s pretty normal; market recoveries often result in a slow and tentative return to a previous all-time high.… Read more

Recent Comments